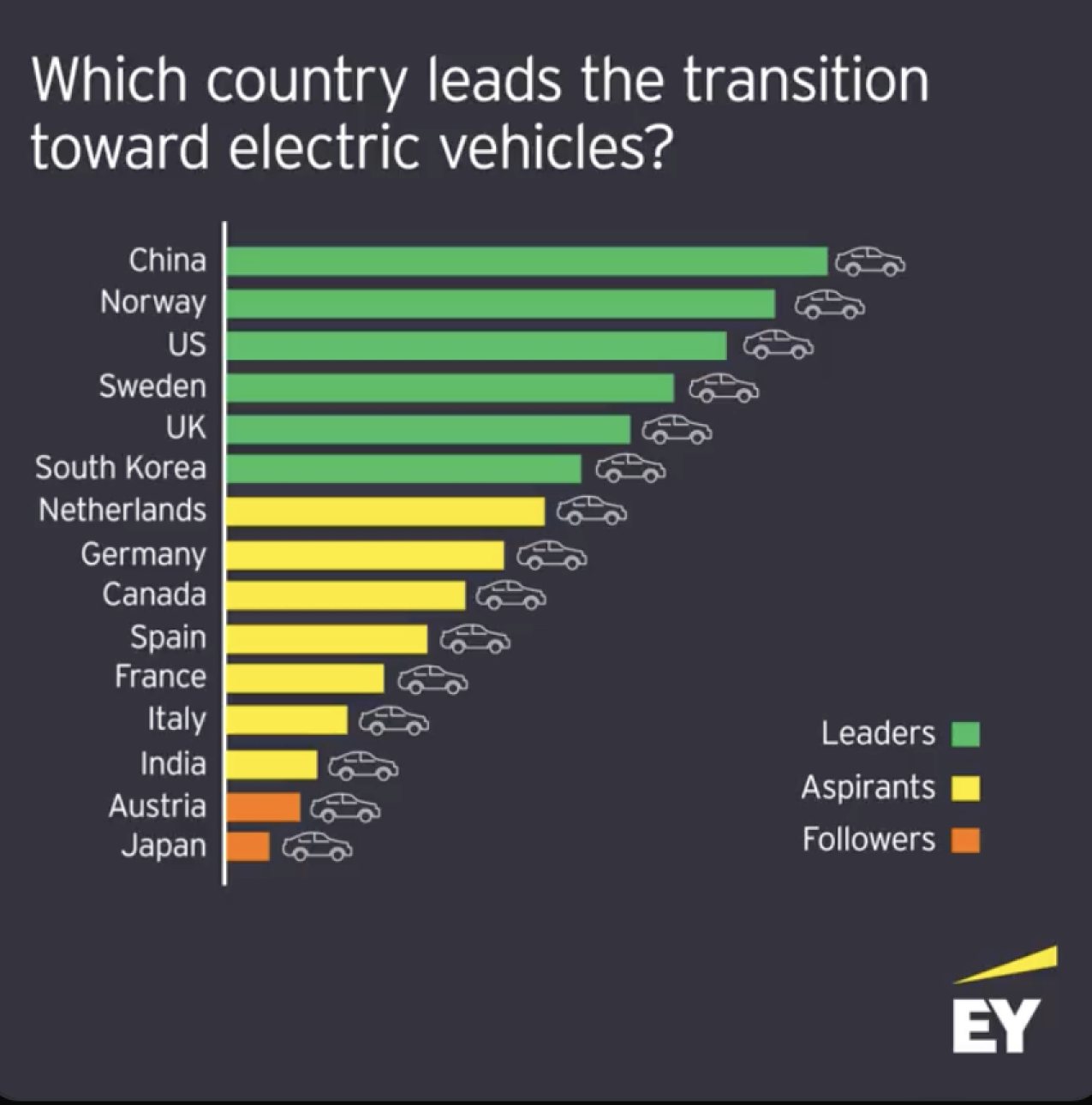

US advances in EV preparedness, Norway and China take the lead

China maintains its dominating lead in the most recent EY Electric Vehicle Country Readiness Index, with Norway not far behind. Notably, the United States has advanced significantly to take the third position, demonstrating the speeding up of the switch to electric mobility globally.

China holds its position as the top country ready for an electric future and continues to drive the global electric vehicle (EV) boom. The massive investment in battery manufacture (which will account for 74% of all worldwide investment in 2022), skyrocketing consumer demand (58% of Chinese customers want to purchase an EV in the near future), and robust charging infrastructure are the main forces behind this supremacy. The world’s largest EV market by volume is still China.

Norway, a pioneer in EV adoption, continues to rank as the country with the second-highest level of EV readiness. Due to significant subsidies and a high GDP per capita, the nation has an astounding 81% adoption rate of EVs, making them accessible to the general public. In addition, between 2022 and 2027, 83% of new cars in Norway will be electric.

The United States moved up to third place, jumping from eighth. This quick rise is linked to advancements in automobile models, large investments in battery production, and government policies intended to boost EV demand. The Inflation Reduction Act and other recent federal tax subsidies have encouraged consumers to choose EVs, leading to an 11% increase in global EV production.

Even though there are more people buying EVs globally as a result of things like performance enhancements, more charging infrastructure, and lessened “range anxiety,” problems still exist. With an EV uptake of 81%, Norway is in the lead, followed by Sweden (53%) and the Netherlands (35%). However, with 8.3 and 1.5 million units anticipated for sales in 2023, respectively, China and the US are in the lead in terms of absolute EV sales.

EV sales have surpassed immediate customer demand in several key countries despite this development.

The fifth-placed UK confronts obstacles, such as decreased OEM and battery manufacturer investments as a result of more alluring incentives in the US and China. But it’s anticipated that the UK’s decision to phase out internal combustion engines by 2030 will increase demand for electric cars.

Due to reduced EV subsidies and anticipated declines in demand, particularly from enterprises, Germany dropped from fourth to eighth place. With 26 EVs per charging station, the nation also needs to upgrade its EV infrastructure.

Italy trails behind its European neighbors, coming in at number 12, mostly because of a deficient charging infrastructure and an underdeveloped energy ecology. With a preference for hybrids over battery electric cars (BEVs) and a lack of investment from significant domestic OEMs, Japan, which is ranked 15th, has seen a severe decline in EV demand.

The race to electrify automobiles is already underway, with China and Norway leading the way, the US gaining ground, and each country dealing with its own difficulties as it moves toward an electric future.

Source: EY

Bạn cần đăng nhập để tương tác với nội dung này: Đăng nhập.